Stockspot Video Series

Videos to help you learn about investing and Stockspot

Videos to help you learn about investing and Stockspot

Starting today and investing smaller amounts over time reduces the impact of ups and downs in the share market, helping you start building your wealth sooner.

We compare the pros and cons of cash, shares, bonds and property.

Find out how we build and manage your investment portfolio with the hassle - and cost - of doing it yourself or paying a traditional advisor to do it for you.

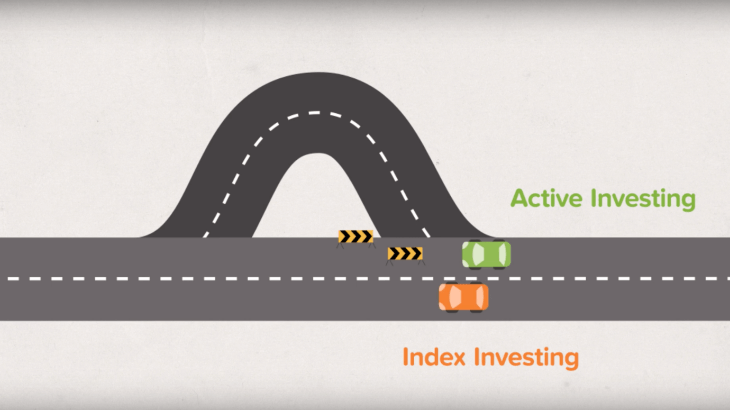

Find out about the benefits of index investing (also known as passive investing) instead of actively buying and selling shares or trying to time the market.

ETFs (exchange traded funds) give you access to thousands of shares, helping you diversify your portfolio into the market index, without the risk of buying individual shares.

We debunk 3 common myths about investing and explain why they’re not true.

Diana has one child, 2 step-kids and another one on the way. She wants her kids to understand the value of money and how it works.

Guy is a busy young professional, so doesn’t have a lot of time left over for managing investments.

Meet an SMSF client and a property investor that have trusted Stockspot to help achieve their financial goals, as seen on Channel 7 news.

Every dollar that you save and invest now helps you to reach your future goals.

Keeping a buffer of cash in a savings account is your own personal insurance policy in case of the unexpected.

Your investment timeframe and your capacity to take risk helps us build the best investment strategy for you to reach your goals.

Once you’ve built up some savings in your account, it’s worth considering where you can get better returns on your money.

We show you how you can save up for deposit faster rather than leaving your money in a savings account.

We help you weigh up the pros and cons of property ownership vs the potential returns you can make by renting and investing your savings.